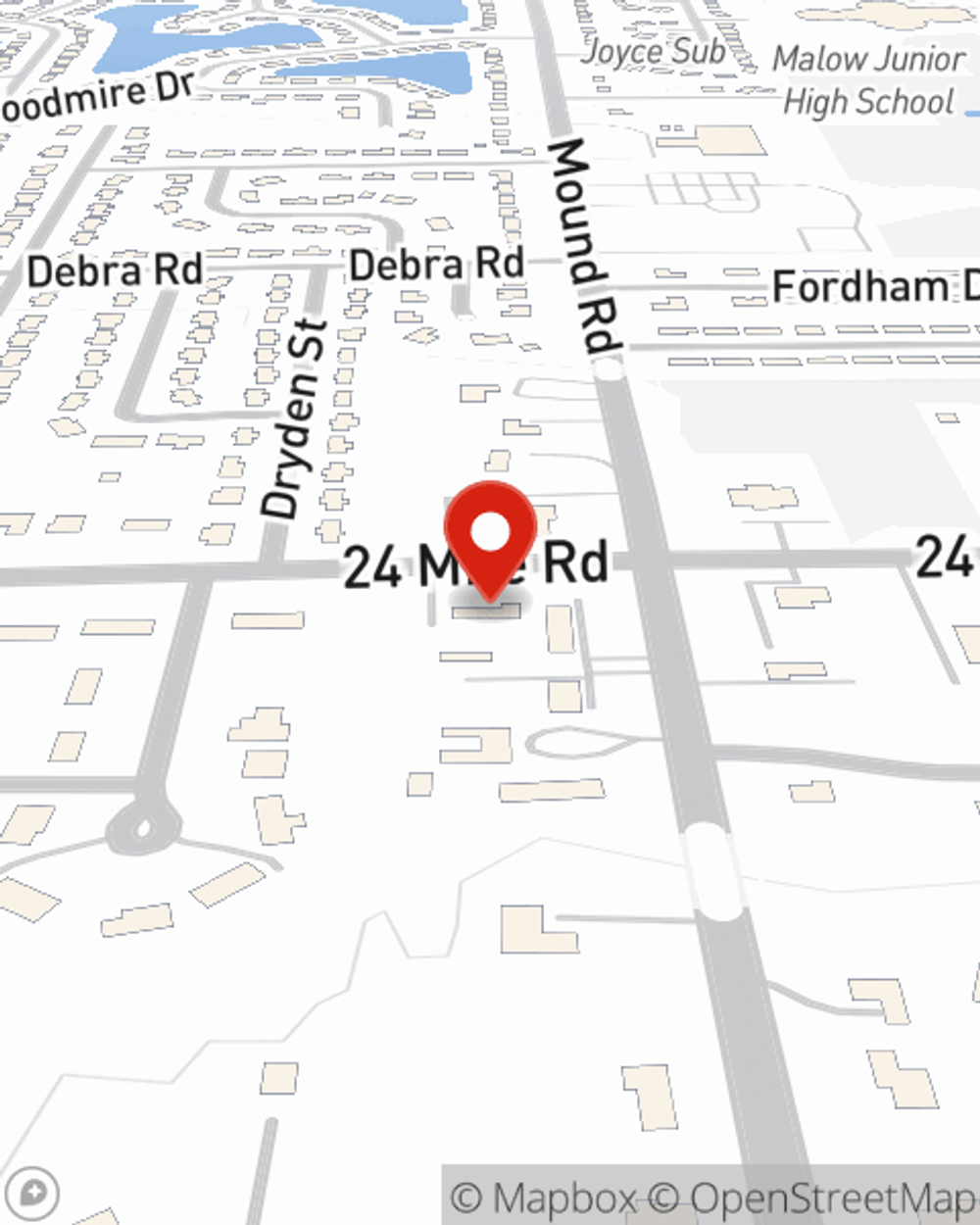

Business Insurance in and around Shelby Twp

Get your Shelby Twp business covered, right here!

This small business insurance is not risky

- Rochester

- Utica

- Sterling Heights

- Washington

- Eastpointe

- Warren

- Highland Park

- Auburn Hills

- Macomb

- Port Huron

- Roseville

- Southfield

- White Lake

- Troy

- Romeo

- St. Clair Shores

- Centerline

- Huntington Woods

- Clarkston

- Royal Oak

- Brighton

- Clinton Township

- Clawson

- Richmond

Business Insurance At A Great Price!

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a staff member gets hurt on your property.

Get your Shelby Twp business covered, right here!

This small business insurance is not risky

Customizable Coverage For Your Business

Planning is essential for every business. Since even your most detailed plans can't predict global catastrophes or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like worker's compensation for your employees and errors and omissions liability. Fantastic coverage like this is why Shelby Twp business owners choose State Farm insurance. State Farm agent Cody Winer can help design a policy for the level of coverage you have in mind. If troubles find you, Cody Winer can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and call or email State Farm agent Cody Winer to identify your small business insurance options!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Cody Winer

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.